Percentage of federal tax withheld from paycheck

The withholding tables have tax brackets of 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and. So when looking at your income tax returns you need to check what income tax rate applies to you.

How To Calculate Payroll Taxes Methods Examples More

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

. 10 12 22 24 32 35 and 37. Your effective tax rate is just under 14 but you are in the 22. The more deductions you claimed the less tax was withheld from your paycheck.

Heres a breakdown of the calculation. The employee pays the remaining. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

The amount withheld per paycheck is 4150 divided by 26 paychecks or. 10 12 22 24 32 35 and 37. Paycheck Deductions for 1000 Paycheck.

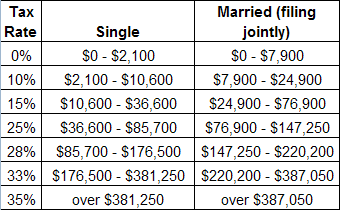

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The federal withholding tax has seven rates for 2021. There are seven federal tax brackets for the 2021 tax year.

The federal withholding tax rate an employee owes depends on their income. 10 percent 12 percent 22. This year you expect to receive a refund of all.

You didnt earn enough. When it comes to Social Security taxes the employer withholds 62 percent of the employees wages and contributes another 145 percent. You pay the tax on only the first 147000 of your.

Tax returns can be broken. The current rate for. 10 12 22 24 32 35 and 37.

Income tax has seven tax rates for 2020. These are the rates for. Your employer will deduct three allowances you and two children at 21924 7308 times 3 from your pay to allow for your withholding allowances.

It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA. The 2019 employer and employee tax rate for. Tax liability is incurred when you earn income.

How much tax is deducted from a 1000 paycheck. A withholding allowance is a claim an employee can make to have less of their paycheck withheld for taxes. This money goes toward.

The federal withholding tax rate an employee owes depends on. If you see that your paycheck has no withholding tax it. In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability.

Per 2020 Publication 15-Ts percentage method table page 58 this employee would be taxed on wages over 526 at 12 percent plus 38. For a hypothetical employee with 1500 in weekly. Social Security and Medicare Withholding Rates.

See where that hard-earned money goes - Federal Income Tax Social. Your bracket depends on your taxable income and filing status. 22 on the last 10526 231572.

The more allowances a worker claims the less money will be. The withholding tables have tax brackets of 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

If no federal income tax was withheld from your paycheck the reason might be quite simple. Correct answer The federal withholding tax has seven rates for 2021. Youd pay a total of 685860 in taxes on 50000 of income or 13717.

The remaining amount is 68076.

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

How To Calculate Federal Income Tax

Federal Tax I M Bad At Spending Money

How To Calculate Federal Withholding Tax Youtube

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Quiz Worksheet Federal Income Tax Withholding Methods Study Com

Paycheck Taxes Federal State Local Withholding H R Block

How To Calculate 2019 Federal Income Withhold Manually

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Paycheck Calculator Online For Per Pay Period Create W 4

Tax Withholding For Pensions And Social Security Sensible Money

Irs New Tax Withholding Tables

Calculation Of Federal Employment Taxes Payroll Services